Mass Index |

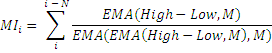

The MassIndex endeavors to locate turns in trends. It is based on changes between maximum and minimum prices. If the amplitude gets wider, the mass index grows; if it gets narrower, the index gets smaller.

The most important mass index signal is a special model formed by the indicator. It is called "reversal bulge". It is formed when a 25-period mass index first rises above 27 and then falls below 26.5. In this case a turn of prices can take place, independently of the general trend - the prices may move up or down or fluctuate within a trade range. When a reversal bulge appears, you should buy if the moving average falls and sell if it rises.

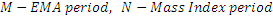

Where

To initialize MassIndex use one of the following constructors:

MassIndex – sets default values: smoothigPeriod = 9, sumPeriod = 3

MassIndex(Int32, Int32) – sets values for periods

Use

MI - properties to get current value

1// Create new instance 2MassIndex massIndex = new MassIndex(18, 6); 3 4// Number of stored values 5massIndex.HistoryCapacity = 2; 6 7// Add new data point 8massIndex.Add(Bars.Current.Open, Bars.Current.High, Bars.Current.Low, Bars.Current.Close, Bars.Current.Volume); 9 10// Get indicator value 11double IndicatorValue = massIndex.MI; 12// Get previous value 13if (massIndex.HistoryCount == 2) 14{ 15 double IndicatorPrevValue = massIndex[1]; 16}