On Balance Volume |

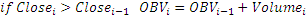

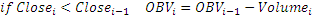

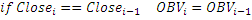

Obv technical indicator is a momentum technical indicator that relates volume to price change. When the security closes higher than the previous close, all of the day’s volume is considered up-volume. When the security closes lower than the previous close, all of the day’s volume is considered down-volume.

To interpret the Obv, look for the Obv to move with the price or precede price moves. If the price moves before the Obv, then it is a non-confirmed move. A series of rising peaks, or falling troughs, in the Obv indicates a strong trend. If the Obv is flat, then the market is not trending.

When the Obv changes to a rising or falling trend, a "breakout" has occurred. Since Obv breakouts normally precede price breakouts, investors should go long on Obv upside breakouts. Likewise, investors should sell short when the Obv makes a downside breakout. Positions should be held until the trend changes.

Indicator has no input parameters. To initialize Obv indicator use the following constructor:

Use

OBV - property to get current value.

1// Create new instance 2Obv obv = new Obv(); 3 4// Number of stored values 5obv.HistoryCapacity = 2; 6 7// Add new data point 8obv.Add(Bars.Current.Open, Bars.Current.High, Bars.Current.Low, Bars.Current.Close, Bars.Current.Volume); 9 10// Get indicator value 11double IndicatorValue = obv.OBV; 12// Get previous value 13if (obv.HistoryCount == 2) 14{ 15 double IndicatorPrevValue = obv[1]; 16}