Volume Weighted Average Price |

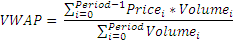

Vwap is the ratio of the value traded to total volume traded over a particular time horizon (minute or one day, etc). It is a measure of the average price of a security traded over the designated trading range. Vwap is often used as a trading benchmark by investors who aim to be as passive as possible in their execution. Many pension funds, and some mutual funds, fall into this category. The aim of using a Vwap trading target is to ensure that the trader executing the order does so in-line with volume on the market. It is sometimes argued that such execution reduces transaction costs by minimizing market impact (the adverse effect of a trader's activities on the price of a security).

To initialize Vwap use one of the constructors provided:

Vwap – in this case indicator will be calculated by expanding window similar to cumulative moving average

Vwap(Int32) – sets period for indicator

Vwap(TimeSpan) – sets time period for indicator

Use

VWAP - property to get current value

1// Create new instance 2Vwap vwap = new Vwap(20); 3 4// Number of stored values 5vwap.HistoryCapacity = 2; 6 7// Add new data point 8vwap.Add(CurrentPrice, Bars.Current.Volume); 9 10// Get indicator value 11double IndicatorValue = vwap.VWAP; 12// Get previous value 13if (vwap.HistoryCount == 2) 14{ 15 double IndicatorPrevValue = vwap[1]; 16}