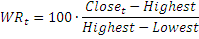

WR |

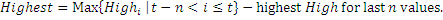

Williams’ %R(Wr) is a dynamic technical indicator, which determines whether the market is overbought or oversold. Williams’ %R is very similar to the Stochastic Oscillator. The only difference is that %R has an upside down scale and the Stochastic Oscillator has internal smoothing. To show the indicator in this upside down fashion, place a minus symbol before the Williams Percent Range values (for example -30%). One should ignore the minus symbol when conducting the analysis.

Indicator values ranging between 80 and 100% indicate that the market is oversold. Indicator values ranging between 0 and 20% indicate that the market is overbought.

Where:

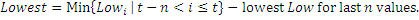

To initialize Wr indicator use one of the following constructors:

Wr – sets default values: period = 14

Wr(Int32) – sets period for indicator

Wr(TimeSpan) – sets time period for indicator

Use

WR - property to get current value

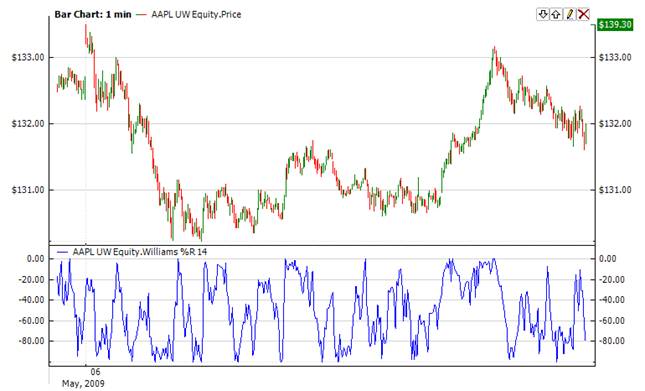

1// Create new instance 2Wr wr = new Wr(28); 3 4// Number of stored values 5wr.HistoryCapacity = 2; 6 7// Add new data point 8wr.Add(Bars.Current.Open, Bars.Current.High, Bars.Current.Low, Bars.Current.Close, Bars.Current.Volume, CurrentTime); 9 10// Get indicator value 11double IndicatorValue = wr.WR; 12// Get previous value 13if (wr.HistoryCount == 2) 14 15{ 16 double IndicatorPrevValue = wr[1]; 17}