Moving Average Convergence |

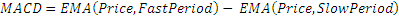

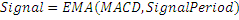

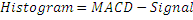

The Moving Average Convergence/Divergence (Macd) is the difference between two Exponential Moving Averages(Ema). The Signal line is an Exponential Moving Average of the Macd. The Macd signals trend changes and indicates the start of new trend direction. High values indicate overbought conditions, low values indicate oversold conditions. Divergence with the price indicates an end to the current trend, especially if the Macd is at extreme high or low values.

When the Macd line crosses above the signal line a buy signal is generated. When the Macd crosses below the signal line a sell signal is generated. It is also popular to buy/sell when the Macd goes above/below zero.

To calculate Macd in a strategy you can use the following constructors:

Macd – sets default values: fastPeriod = 12, slowPeriod = 26, signalPeriod = 9.

Macd(Int32, Int32, Int32) – sets periods for indicator

Use

properties to get current value.

1// Create new instance 2Macd macd = new Macd(14, 28, 9); 3 4// Number of stored values 5macd.HistoryCapacity = 2; 6 7// Add new data point 8macd.Add(CurrentPrice); 9 10// Get indicator value 11double IndMACD = macd.MACD; 12double IndSignal = macd.Signal; 13double IndHistogram = macd.Histogram; 14 15// Get previous values 16double IndPrevMACD = macd[1].MACD; 17double IndPrevSignal = macd[1].Signal; 18double IndPrevHistogram = macd[1]. Histogram; 19Checks for Signal line crosses MACD line: 20using FinAnalysis.TA; 21using FinAnalysis.Base; 22Macd macd; 23 24public override void OnInit() 25{ 26 //... 27 // Create new instance, MACD(14, 28, 9) 28 macd = new Macd(14, 28, 9); 29 30 // Store 2 indicator values 31 macd.HistoryCapacity = 2; 32 //... 33} 34 35public override void OnBarClose() 36{ 37 //... 38 macd.Add(CurrentPrice); 39 40 // Checks for values in memory 41 if (macd.HistoryCount >= 2) 42 { 43 // Checks for cross 44 if (macd.MACD > macd.Signal && macd[1].MACD <= macd[1].Signal) 45 { 46 // Long position 47 } 48 49 50 51 if (macd.MACD < macd.Signal && macd[1].MACD >= macd[1].Signal) 52 { 53 // Short position 54 } 55 } 56 //... 57}