Ultimate Oscillator |

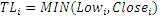

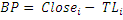

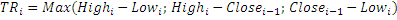

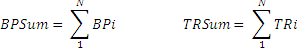

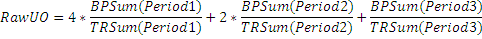

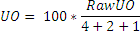

UltimateOscillator uses a weighted total of three oscillators with different calculation periods. The oscillator uses three time spaces that can be set manually. Default values for these periods are 7, 14 and 28 periods. Note that longer periods are comprised of shorter ones. That means that 28-period values discount 14-period and 7-period values. Therefore, we use the values of the shortest period three times, so these values influence the result of the oscillator the most.

Typically UltimateOscillator generates a buy signal when it falls below 30 and a sell signal when it rises above 70.

To initialize UltimateOscillator use one of the following constructors:

UltimateOscillator – sets default values: period1 = 7, period2 = 14, period3 = 28

UltimateOscillator(Int32, Int32, Int32) – sets values for periods

UltimateOscillator(TimeSpan, TimeSpan, TimeSpan) – sets time periods

Use

OscillatorValue - property to get current value

1// Create new instance 2UltimateOscillator ultOscillator = new UltimateOscillator(14, 14, 28); 3 4// Number of stored values 5ultOscillator.HistoryCapacity = 2; 6 7// Add new data point 8ultOscillator.Add(Bars.Current.Open, Bars.Current.High, Bars.Current.Low, Bars.Current.Close, Bars.Current.Volume); 9 10// Get indicator value 11double IndicatorValue = ultOscillator.OscillatorValue; 12// Get previous value 13if (ultOscillator.HistoryCount == 2) 14{ 15 double IndicatorPrevValue = ultOscillator[1]; 16}