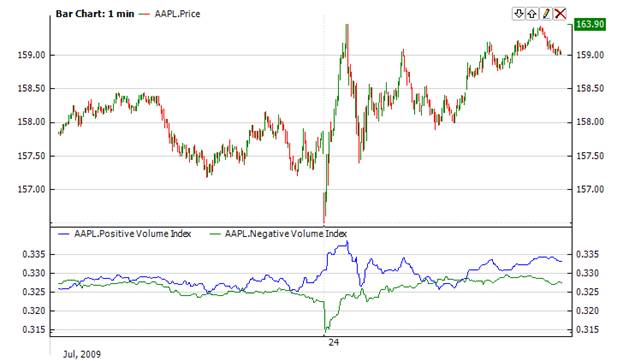

Positive Negative Volume Index |

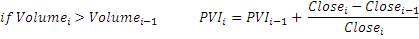

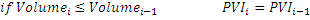

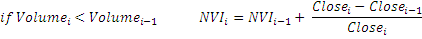

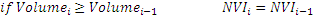

The Positive/Negative Volume Index (VolumeIndex) attempts to identify bull markets. The Positive Volume Index (PVI) shows what the uninformed investors are doing, while the Negative Volume Index (NVI) shows what the smart investors are doing. It is based on the assumption smart investors dominate trading on light volume days and uninformed investors dominates trading on active days. The PVI changes on days when the volume is up and stays flat on down volume days.

If NVI line above PVI it means a new trend is emerging. If, after that, PVI line crosses NVI line and stays above it, a long position can be opened.

Positive

Negative

Indicator has no input parameters. To initialize VolumeIndex use one of the following constructors:

Use

properties to get current value

1// Create new instance 2VolumeIndex volIndex = new VolumeIndex(); 3 4// Number of stored values 5volIndex.HistoryCapacity = 2; 6 7// Add new data point 8volIndex.Add(Bars.Current.Open, Bars.Current.High, Bars.Current.Low, Bars.Current.Close, Bars.Current.Volume); 9 10// Get indicator value 11double IndPotitiveIndex = volIndex.PVI; 12double IndNegativeIndex = volIndex.NVI; 13// Get previous values 14if (volIndex.HistoryCount == 2) 15{ 16 double IndPrevPotitiveIndex = volIndex[1].PVI; 17 double IndPrevNegativeIndex = volIndex[1].NVI; 18}