Williams AD |

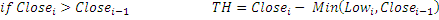

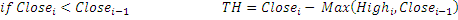

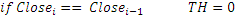

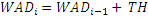

Williams' AD (Wad) is the accumulated sum of positive "accumulational" and negative "distributional" price movements. For example, if the current closing price is higher than the previous one, Wad increases by the difference between the current closing price and the true minimum. If the current closing price is lower than the previous one, Wad decreases by the difference between the current closing price and the true maximum.

If the price reaches a new minimum, but the accumulation/distribution indicator cannot reach a new minimum, it means that the security is accumulating. This is a buy signal. If the price reaches a new maximum, but the accumulation/distribution indicator cannot reach a new maximum, it means that the security is distributing itself. This is a sell signal.

Indicator has no input parameters. To initialize Wad indicator use the following constructor:

Use

WAD - property to get current value

1// Create new instance 2Wad wad = new Wad(); 3 4// Number of stored values 5wad.HistoryCapacity = 2; 6 7// Add new data point 8wad.Add(Bars.Current.Open, Bars.Current.High, Bars.Current.Low, Bars.Current.Close, Bars.Current.Volume); 9 10// Get indicator value 11double IndicatorValue = wad.WAD; 12// Get previous value 13if (wad.HistoryCount == 2) 14{ 15 double IndicatorPrevValue = wad[1]; 16}